Chinese wine market: Through the valley of recession

Photo and Text : Maxime LU

In recent years, policy to clampdown gifting and ostentatious display of wealth among officials, along with decelerated growth of Chinese economy has sent Chinese wine market into trough period. In a different perspective however, it also signals opportunities for return of a much healthy,amorepersonal- consumption oriented wine market. Such transition has promoted domestic wine industry to be explored and try new market model. Foreign wine makers and wine regionassociations have found out the capital that they invested in brand promotion didn’t bring satisfactory result in recent years. Adjusting strategies and adopting more effective measures, effectively increasing brand awareness are many wine industry business objectives, here are a few points that need special attention:

1.Make sure your brand image isheard as widely as possible.

Paying attention to the propagation accuracy and diversity is one of the keys. Organizers invest time, manpower and material resources to host a perfect dinner or tasting event, but often reluctant to invest more resources and efforts on the propagation. Without enough exposure to propagate the brand image expressed by these events adequately, nor do enough distribution channels to let target audiences to understand your promotion campaign, it is undoubtedly getting half the result for the same effort. Increasing your brand activities exposures as much as possible is the most important part, it doesn’t necessarily means you have to invest a large sum of budget. By choosing a flexible promotion model and correct channels which can achieve high rate of dissemination, your promotion activity can achieve effects of multiple promotion campaigns.

2.Select the effective brandcommunication channels.

Choosing traditional media with precise target audience such as paper magazines and books, or faster spreading and higher flexibility media such as websites, APP,public WeChat channel, but also from included self-published media like blog,Weibo and Circle of Friends of WeChat Channel. As the whole society has entered the age of Multi-media, business must have a clear understanding and enough analysis on: their main target audience, considerations of timeliness, channel efficiency and coverage, as well as the cost of each delivery channel. As for the traditional paper media whose influences have been weakened gradually, one must take into account the reality of its circulation and delivery site, compared to this, wine books have even narrower distribution.

Now let us move to self-publishing media.In order to attract more original contents, a lot of major platforms have endowed wider distribution of its content via multidevice/ OS friendly platform, such as PCfriendly, mobile browser friendly and app. In this era where a friend gathering evolved into a much-maligned scene where everyone bows to play their mobiles, the visitor volume of a rising self-publishing media on PC and mobile browser views may not be high, but the visitors volume on its related channel on their mobile apps platform is usually rather impressive while being more accurate at the same time. These distribution channels have a better dissemination of results, on the other hand, the price-efficiency of releasing news with self-publishing media at this stage is not bad at all.

3.Comprehensive considerationand choosing flexible way to promote.

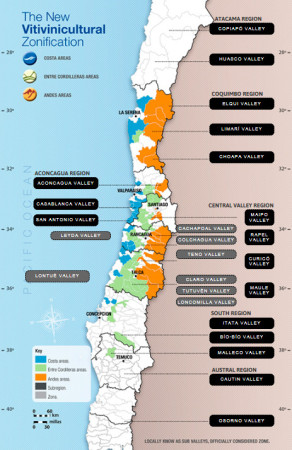

Trainings, lectures, wine exhibitions are common ways to promote but mainly limited to the wine industry professionals only. In addition, one can leverage with using the Chamber of Commerce or association to represent the overall image of a wine producing region, selecting high traffic supermarkets, shopping malls, organic markets to carry out wine culture themed festivals, or even promote experient ial market ing in the now personal-consumption dominated market. For example, most of the Chilean wine are suitable for everyday drinking, they are easy to resonate with their fruit & sweet spices aroma as the leading aroma, easy to drink, soft tannins, easy to access and higher acceptance to primary consumers, are particularly suitable for this type of experiential marketing, coupled with the Chilean wine price advantage, it can directly and efficiently attract to customers.

2015 will be the year of recovery for the wine market, although not necessarily a substantial growth, but judging the data from the past few months and feedbacks from vintners of different scale, we are optimistic about this year’s rebound. In the past two years, Chinese wine industry has invested heavily to popularize and promote the wine culture and it has achieved initial success, more and more consumers who have been purchasing power of wine began to understand the basic wine knowledge. Some consumers who are interested in wine have even equipped themselves with advanced wine knowledge, and gradually developed themselves as opinion leaders in their own social circles.

Demand of China’s personal-consumption market also grows vigorously in market cultivation and wine culture education&promotion. At the present, it is a critical time for wine-producing countries, like Chile, to further open up a new prospect in the Chinese market. Stable quality, suitable taste for the market, the tariff gimmick, these should be anenduring promotion campaign instead of several intensive period of promotion activities. You do not have to burn money to carry out a largescale activities, as long as you rely on the industry associations or chambers of commerce that can easily win public trust, you can just cyclically carry out some small but propagation-effect oriented activities. This doesn’t need a lot of money but precise positioning, appropriate and flexible pattern, and strategies that suits the status quo for the Chinese market. Currently the major producing countries are actively promoting to seize market share in China, if not being aggressive at the moment, one will eventually fall behind and cede out the market one has won.