中国葡萄酒市场与教育推广

陆江(Maxime LU)/ 万欧兰文化

本文版权属于Prowine China,转载请标明出处“Prowine China”

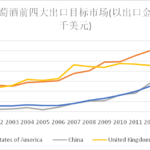

近十年来,中国葡萄酒市场以其庞大市场潜力和较快发展速度,受到全球大多数产区国的重视和努力介入,也吸引了不少资本进入这个市场。但是从2012年开始,中国政府采取限制三公消费的政策,加之近年来经济增速放缓,以及行业浮躁盲目的冒进积累,导致中国葡萄酒市场快速进入回调期。2013年葡萄酒进口总量,相比2012年下降4.46%,而今年2014年上半年的葡萄酒进口量与去年同期相比下降了12.8%。

原来葡萄酒市场主要聚焦在公务消费和集团消费上,团购送礼宴请占主要市场份额,现在随着三公限制和经济走缓后,这块市场急剧萎缩,这时个人型消费又重新回到市场关注焦点。而现在面临的市场调整,之所以表现那么惨烈,是因为市场环境变化突然,其效果有点硬着陆的意味。在这剧变中,不少商家受到冲击,尤其是太过依赖团购或公务消费的酒商,业绩影响显著,少数遭受灭顶之灾。不过对于中国葡萄酒市场,其实是有利有弊。在短期内它会是个剧烈阵痛,从长远来说,提前到来的硬着陆,以及价值回归,对整个行业的拨乱反正效果也很明显。

葡萄酒教室/陆江摄

面对个人消费和价值回归的市场发展方向,行业里一些有远见的企业反应迅速,过去一年中,一方面灵活调整价格体系和销售方式以适应个人消费的特点,另一方面,调整市场推广策略,在不景气的行情中积极采取措施,挖掘市场,尤其是通过加大不同形式的葡萄酒教育力度,开发培养新老客户,创造需求,挖掘新的消费点。像进口葡萄酒行业里的翘楚企业ASC,富隆,也买网,华致等都明显加大提升葡萄酒教育团队或市场部门的专业能力的力度,积极对外合作,从常规的葡萄酒系统课程,到不同的产区课,还有丰富多样的大师班,在企业和品牌推广、客户开发中达到事半功倍的效果。

另外,整体葡萄酒市场虽然从进口额和进口量上看似不太景气,可事实上现在市场开始理性,前几年冲动盲目压的货数量不少,今年都在消化调整中,看市场里冒出数量不少的尾货或甩货就能大概知道原委。其实个人消费量的增加也很明显。这点可以从主要面向个人消费的葡萄酒电商的销售量的持续快速增长,窥豹一斑。另一方面,从葡萄酒教育市场本身的蓬勃发展也能看出端倪。各地大师班,产区课的开课数增长迅速。还有葡萄酒系统课程的参与者,以英国WSET课程为例在大陆短短十年左右的发展,特别是最近两三年,学生数量增长快速,现在中国市场已是WSET的全球最大生源国之一,由于需求旺盛,各地授课点的数量还在不断增加。

品酒会/陆江摄

与此同时,在中国葡萄酒市场中意图分取更大份额的国外产区也在寻求突破口,其中官方产区课,以及国际葡萄酒大师开设的大师班,就是行之有效的突破方式。现在中国市场上销售额占据前两位的法国和澳大利亚,就是产区课推广中的佼佼者。

法国从上世纪九十年代末就开始进入中国市场,是在中国最早实行产区课程教育的国家,尤其在2007年开始进行的波尔多葡萄酒学校讲师认证项目和官方课程的推出,将业内有影响力的专业人士变为波尔多的官方讲师-推广大使,这分布各地的数十位官方讲师每年有相应的培训量要求,从而通过几十位的讲师将产区知识不断地传播到全国各地的从业者和葡萄酒爱好者。这一模式也逐渐被其它产区在借鉴,其中最成功的是澳洲A+产区课程,他们用更多的讲师支持力度和激励机制,使澳大利亚A+课程的推广效果在很短时间内就赶上波尔多,甚至有超越之势,当然市场也给了相应的回报。此外产区或葡萄酒庄,也可以采用和有影响力的展会,以及本地教育机构合作的形式,开设大师班,品鉴会等形式,选择特定的传播受众,如葡萄酒讲师,媒体,消费意见领袖等,也能收到上佳的效果。如在即将到来的ProWine China酒展上就会有相应的葡萄酒课程。

中国葡萄酒市场似乎是萧条冰封之际,可冰层下面蕴含着勃勃生机和蓄势待发,这主要推力之一,就是对消费者和从业者的葡萄酒教育。葡萄酒教育能让这个市场更加理性,更加健康,也更有商机。

Prowine China展会期间的同期活动的介绍页面链接:http://www.prowinechina.com/channels/169.html

Wine Market and Education Promotion in China

– LU Jiang (Maxime) / WineSchool China –

Due to the great potential and rapid growth of China’s wine market, the past decade has witnessed the attention and participation from most wine producing countries worldwide. Much investment has flown into the market. However, in 2012 the Chinese government has adopted the policy of restricting three public consumptions (oversea trips, vehicles and banquets). Furthermore, sluggish economic growth and rash investment in the sector has made conducting business in China’s wine market a bleaker landscape more challenging. Wine imports have decreased by 4.46% (YOY) in 2013 and by 12.8% (YOY) in the first half of 2014.

Official and corporate consumption used to be the bulk of Chinese wine sales. Corporate purchases, gift-giving and dinners occupied the lion’s share of the market. By restricting three public consumptions combined with a stagnating economy, the relevant market share shrank dramatically. Individual consumption has become the focus of the market. The market changed unexpectedly and eventually experienced a hard landing. During the change, many dealers suffered greatly as they relied heavily on corporate or official consumption. Sales dropped remarkably and some dealers even retreated from the Chinese market. Nevertheless, the outlook for the industry is mixed. In short term, the drastic changes will unsettle dealers, but in the long run the industry’s hard landing and the value return will contribute to a healthy contraction and eventually higher quality standards of the Chinese wine industry.

As for individual consumption and the market orientation for value return, some witty entrepreneurs have acted swiftly. Over the past year, they have flexibly readjusted the pricing and sales strategies to cater for personal consumption. On the other hand, they have improved marketing strategies and taken measures to explore the market against the bleak backdrop. They, in particular, have devoted much effort in education campaigns by cultivating regular customers and newcomers, creating demand and exploring new fields of consumption. Leading wine import businesses like ASC, Aussina World Wines, yesmywine.com and Vats Liquor have put much effort into capacity building in their education teams or marketing departments. They have initiatively cooperated with others to conduct standard systematic courses, different courses on wine regions and various master courses. Their efforts pay off in the promotion of enterprises and brands and customer development.

Although the wine market’s outlook seems to be grim in terms of imports and exports as a whole, the market is becoming more rational. The stockpile out of indiscriminate purchase is being consumed this year, as we can see from a lot of leftover stock or bargains. Actually, personal consumption has increased obviously, which can be seen by soaring e-commerce sales. On the other hand, the burgeoning growth of the wine education market manifests this trend. Master courses and courses on wine regions are on the rise. There are participants of wine systematic courses. Take WSET course from Britain as an example. After the past decade’s growth, especially for the last 2-3 years, their student numbers have increased rapidly. Nowadays, China is one of the largest providers for WSET students. Due to the strong demand, sites of lecturing are on the rise.

Meanwhile, oversea wine producers are trying to break bottleneck in an effort to pursue larger market shares in China. Among their efforts, official courses on winegrowing regions and master courses lectured by international wine masters are effective in practice. France and Australia, top sellers in the Chinese market, are two leading promoters for courses on wine regions.

France found its way into China in the late 1990s. As a pioneer of introducing courses

China’s wine market is currently in a turmoil. Nevertheless, there are signs of great potential and burgeoning growth. One of the major driving forces is wine education for consumers and industry players. Wine education will make the market more rational and healthier and will also offer more business opportunities.